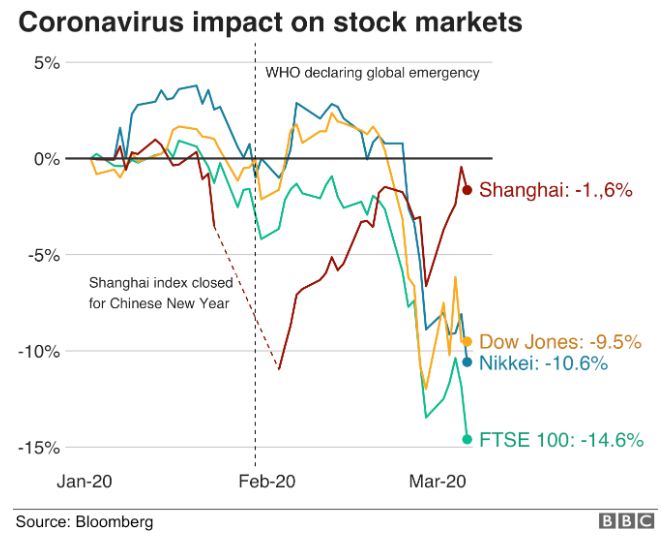

Initial expectations for the impact of Coronavirus on the UK media Industry are mixed. Whilst both international and UK markets continue to struggle, the FTSE 100 dropped nearly 9pc on the 9th March as global oil prices plunge which equates to circa £130bn.

This plunge in the stock market echoes fears that procedures put in place to contain the virus, such as factory shutdowns and restrictions on movement, will cripple global economic growth. The Organization for Economic Development estimates that Coronavirus escalation could cut global economic growth almost in half from 2.9% to 1.5% in 2020.

So, what does this mean for the UK Media industry?

Whilst there has been continuing uncertainty from Brexit, the expectation is that as marketers and companies see reduced profit margins, budgets will see a reduction too. Whilst still early on in the outbreak, close to half (45%) of retail respondents in a Retail Economics study say they have already seen a negative impact on sales; with three-quarters expecting to see a decline in sales if the outbreak persists.

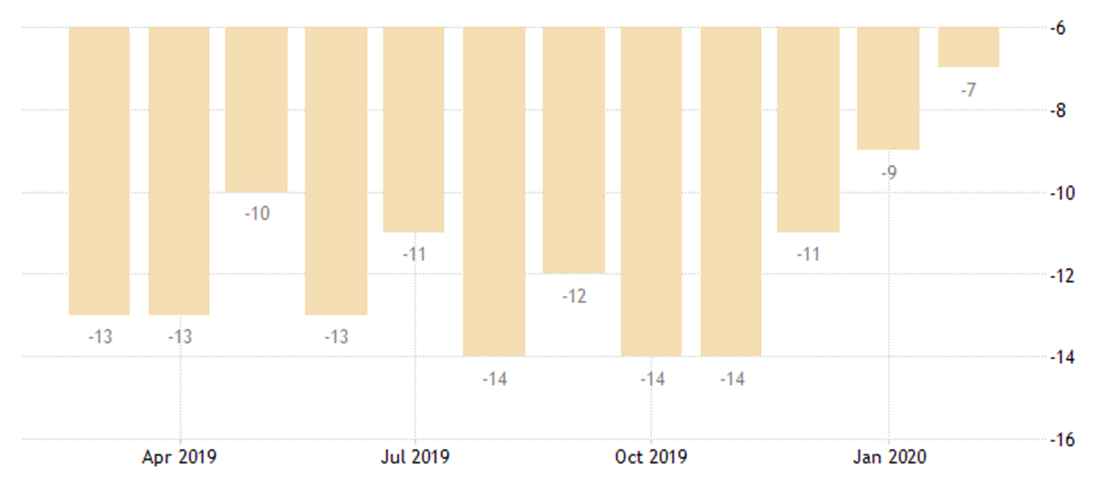

UK consumer confidence saw an increase in February up to -7pc from -9pc however this failed to account for the impact and rate of growth of the virus within the UK and Europe. Initial studies suggest that the data figures in March will see a significant drop, as 60% of consumers in a Mintel study on the virus saw it to be a severe to moderate concern. Additionally, the drop in the FTSE 100 is likely to further impact results similarly to the Brexit effect we saw at the end of last year.

The impact on specific sectors

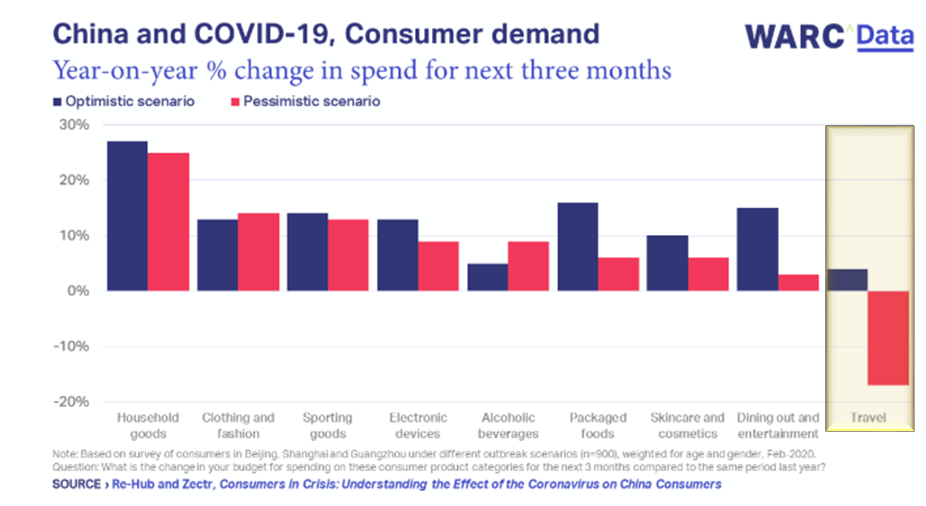

Looking at a WARC study focussing on consumer demand in China as a benchmark, we can see that many categories should not be heavily impacted by Coronavirus, with ‘luxury’ items such as electronic devices, packaged foods, skincare and cosmetics only seeing moderate decreases in a pessimistic scenario. However, Travel and Leisure (dining out and entertainment) is by far projected to be hit the hardest by Coronavirus, and should the UK reach the same degree of threat as China has, we would see a similar level of impact.

Whilst the impact appears to vary depending on the vertical the product sits within, Travel and Leisure within the UK are already particularly vulnerable at the moment with the likes of Flybe entering administration after a continued period of uncertainty, and the release of the next film in the James Bond franchise, ‘No Time To Die’, postponed until November owing to profit concerns.

Looking more closely at the Travel market, Air Travel and Cruise appear to be the hardest hit, with reports stating that Coronavirus travel related disruptions in the Middle East have created a $100 million loss. The Cruise market has been hit during the strongest sales period of the year, with higher volumes of cancellations and half-empty ships setting sail, expecting to cause large losses for the rest of the year. With the previous prediction that 32 million passengers would embark on Ocean cruises in 2020, with Asia being a key destination, the effect of the publicity around the ‘floating petri-dish’ the Diamond Princess is as yet unknown.

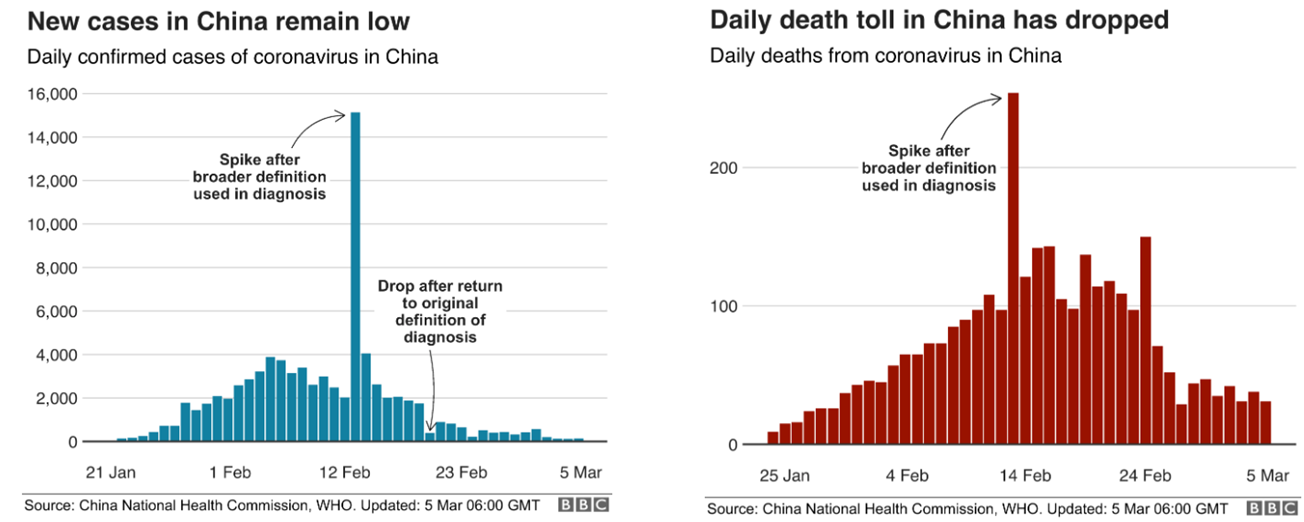

However it is not all bad news, as the number of new cases in China remains low and the rate of infection appears to have significantly reduced. Additionally, the daily death toll has fallen suggesting that whilst the numbers in the UK are rapidly rising, we will see a slowing after a few weeks and the gestation period has passed.

As it stands there is a degree of ‘wait and see’ with few brands wanting to pull advertising spend at this early stage and instead preferring to look at remedial measures such as blacklisting, negative targeting or amending campaigns. However there is an expectation that should the outbreak last longer than three months, these plans might change. Looking back at the 2009 ad recession, it was brand marketing and subsequently TV budgets that took a hit, whilst search and other performance channels remained relatively unscathed.

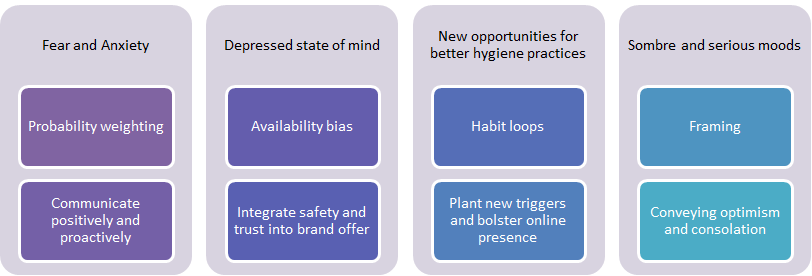

One thing that brands can do is ensure that they are aware of, and appropriately messaging for, the varying moods and attitudes of customers. Behavioural science tells us that a natural fear of the unknown, authority bias and social herding will all have implications on the way that consumers behave throughout the outbreak. One prime example is the extreme toilet paper and antibacterial product buying that has taken place. Many retailers are now being forced to limit purchase numbers as a result. Behavioural changes such as these have obvious implications for consumption. Therefore we need to look beyond the obvious and ensure that we are communicating messages in as positive and proactive way as possible to ease fears.