I was fortunate enough to attend the AutoTrader round table session where we discussed some of the key challenges faced within the Automotive industry. Coupled with a walk through by the Haymarket team regarding their latest What Car? consumer panel research, it’s clear that both OEMs (Original Equipment Manufacturers) and consumers are trying to navigate through a difficult period of uncertainty.

What challenges are the automotive industry facing?

New car manufacturing is at its lowest in almost a decade, with only 1.6m new cars built in 2022 and 2021, compared to 1.8m in 2020, and 2.5m in 2019.

In 2022, supply chain issues for some OEMs have hindered the availability of both EV (electric vehicle) and ICE (internal combustion engine) models, forcing consumers to turn to other brands they may have not otherwise considered. In addition to this, the automotive industry is being negatively impacted by two key areas: 1. The cost-of-living crisis and 2. Infrastructure and consumer understanding.

However, these issues are not the full extent of the problem or exclusive to the EV industry. Other sectors also have to prepare for the impact that the cost-of-living crisis and supply chain issues could have on their business. This article will analyse what some automotive brands have done to navigate, and even succeed, in these difficult times, so that other brands in other sectors could adopt something similar.

1. The cost-of-living

Most households have been hit hard by the cost-of-living crisis. Purchasing a car is a big-ticket item and we’ve seen, in some cases, that the more premium automotive brands are being traded down to a more affordable choice as there is much more scrutiny in the path to purchase journey.

Our client MG, for example, had a successful 2022, despite the negative trends the wider automotive market is seeing, because they position themselves as the ‘affordable electric car for everyone’. This accessibility led to 51,050 new car sales and 3.16% MSOV, which is a large increase year on year.

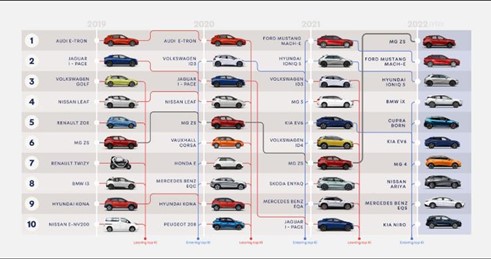

Building on from our fantastic Q4 media campaign, searches for MG’s EV models also skyrocketed on the AutoTrader platform. MG ZS remains in the top 10 most viewed models on the platform and the MG4 is the 7th most viewed in 2022, despite only launching in September last year. This presents MG as a popular option for those browsing on the AutoTrader site, which makes the expensive purchase less of a risk because you’re buying a trusted and popular product.

Coupled with MG EVs being framed as an ‘affordable option’, has helped them succeed in a time where the majority of consumers are looking to save money, and their strong year has led to them winning 3 awards at the What Car? Awards, including ‘Best Small Electric Car for the MG4 EV’.

Image source: AutoTrader

Alternatively, Tesla are trying to navigate the cost-of-living crisis by introducing price cuts in the range of 10% to 13% in the UK, which is a sign of the difficult economic outlook and increased competition from other automotive manufacturers. However, this competition is not specific to the EV market, as times of recession will increase competition in all sectors as brands are fighting for the smaller amounts of money consumers are spending. Therefore, businesses should re-think their pricing strategy if margins can still be made.

Furthermore, brands are not only competing with cheaper rivals, but with pre-owned items that are becoming increasingly popular. For example, What Car? research states that 34% of consumers are looking at buying a used car, and 20% said they are doing so because the cost-of-living-crisis has forced them to switch to a used car to save money.

Therefore, brands need to adapt to this shift in consumer spending habits. If brands currently do not sell used, pre-owned or vintage products then it may be the time to consider this approach within their business model.

2. Infrastructure and consumer understanding

In times of crisis, education is key, and currently there’s lack of consumer understanding around electric vehicles. One of the biggest confusions is around the cost of charging an electric car, which was made worse by the rising cost of electricity, with What Car? finding that increased cost of electricity has changed 37% of people’s perception of EVs. Therefore, to improve knowledge in this area, governments first must improve the infrastructure to make charging an EV as simple and cost effective as possible.

The volume of public charge points in the UK was at around 40k in 2022. However, with reports of 3-hour long ques to charge your Tesla, it’s clear that this type of news isn’t going to do much for persuading consumers to make the switch, which is growing more important as we draw closer to the 2030 deadline when the government will ban the sale of new petrol and diesel cars. Therefore, governments need to work with suppliers to improve the number of charging stations if they want to encourage drivers to make the switch to an electric car.

Furthermore, home charging is currently cheaper than public charging, however they can be costly to install and not all housing accommodates installation. If EVs are to be accessible to everyone, especially in a cost-of-living-crisis, then public charging needs to become a more affordable option. Companies like the RAC reiterate calls for VAT cuts on public EV charging as costs rise 50% in eight months. The rises, driven by further increases in the wholesale cost of electricity, mean that drivers now pay £36 to charge a typical family-sized electric car with a 64kWh battery, which the RAC calculates to be more than twice the cost of charging the same car at home.

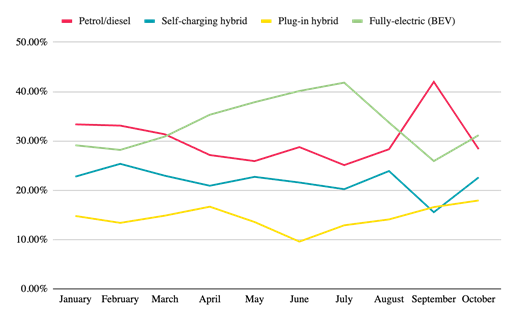

Once the government puts the infrastructure in place to make public charging cheaper, they then need work on educating drivers about the cost of charging an EV, as in September, the majority of drivers reverted back to viewing petrol and diesel as the most likely fuel for their car, seeing the advancements in EV’s going backwards. Could this trend continue?

Image source: What Car? Question – what powertrain will your next car have?

However, the responsibility of education also lies with the OEMs. For example, What Car? research states the average rating of understanding EV technology of a scale of 1-5 (5 being the highest) is between 2.5 and 3, even after more than 3 months of researching, whereas it’s between 4-5 within the ICE market over a shorter time.

Looking at the next 12-18 months, we know there are a lot of new brands coming into the EV market, mainly backed by Asian inventors who’s supply chain is likely to be strong. These new, unfamiliar brands may add to the confusion consumers face, potentially leading to choice overload for consumers and creating even more challenges for existing OEMs. The more traditional and established high end automotive brands will need to face this head on, otherwise they may find themselves losing market share quickly. Therefore, educating consumers about your brand will be vital to help attract new audiences.

This applies to all sectors affected by current supply chain issues. Consumers may no longer be able to buy the brands they normally do, which will lead them to shop elsewhere. Educating consumers about your brand will help keep you front of mind when they start to browse which presents a great opportunity to reach new audiences and generate more sales in a time of uncertainty.

For further insight on how the above learnings may impact your automotive brand, and ways to adapt during this period of uncertainty, please contact us today.